Insurance Aggregator websites (aka Comparison websites) enable clients to complete a single form and obtain quotes from different insurers. Quotes for all insurers are returned, and the potential client can select a quote to purchase. Alternatively, as the quotation is stored in the insurer’s system, the client can return later (say, up to 30 days) to complete the purchase.

Over the past few years, there has been a substantial increase in the number of insurance contracts concluded via the Internet. The aggregators are developed with this in mind. They are marketed as the “ultimate online one-stop insurance shop, giving consumers instant and easy access to a range of insurance solutions tailored specifically to their insurance profile." Particularly prevalent in the personal lines marketplace, aggregators are starting to develop a presence in the commercial lines marketplace. Despite aggregators having a more substantial presence in some markets than others, the study finds that they play an essential role in the industry and have become a significant new business source for almost half of insurers.

Some examples of these sites serving different markets, servicing the personal lines marketplace, are:

- moneysupermarket.com

- gocompare.com

- confused.com

- comparethemarket.com

- insurancemarket.gr

- policybazaar.ae

- aqeed.com

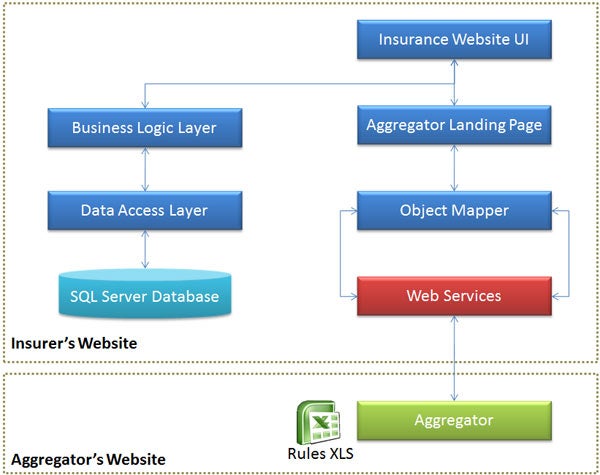

In simple terms, that's how we retrieve a quote:

- Firstly, some basic rules are supplied to the aggregator. For example, only drivers aged over 21 may be acceptable for a motor policy.

- Then, these rules are passed, and the aggregator will call over the internet to the insurer’s system (via a web service) to supply the policy information entered on the aggregator’s site. Then, the response from the web service will return the premium amount and a web address link for the client to click on to proceed with the quote.

Discover Digital has a solution for a reliable, high-performance interface with aggregators. We developed the interface for Principle Insurance and Moneysupermarket.com, one of the United Kingdom's largest aggregators. This basic architecture will be the same for all aggregators. To find out more, please visit our specific product site:

The essential requirements when designing that solution are:

- Speed: The quote list is populated in real time as the results from the various insurers are returned. Therefore, if the response to supply the quote is slow, the client may proceed with one of the competitors.

- Reliability: Potential clients would be prevented from purchasing if the web service has errors or is unavailable. Rigorous load testing is undertaken to ensure that the system can cope with aggregator sites' high volumes.

- Up-selling: It is essential to include the ability to purchase additional services such as Breakdown, Personal Accident, and Legal Cover.

Get in touch today for a real-life demo and start your Insurance Business Transformation!